Cryptocurrency Breakout Trading 101

What is a breakout?

Analyzing breakout patterns is used as a market strategy for many investors in the cryptocurrency space. A breakout occurs when, after many attempts by the seller to lower the price of the coin, they agree to sell at the buyer’s higher price. This then causes the price of a coin breaks through a key resistance level, which is the level at which the price of a coin is impeded by an overwhelming level of supply. At this level, investors are unwilling to pay a higher price for the coin. When a breakout occurs, the price of the coin generally spikes upwards, as investors realize that the price of the coin can rise higher.

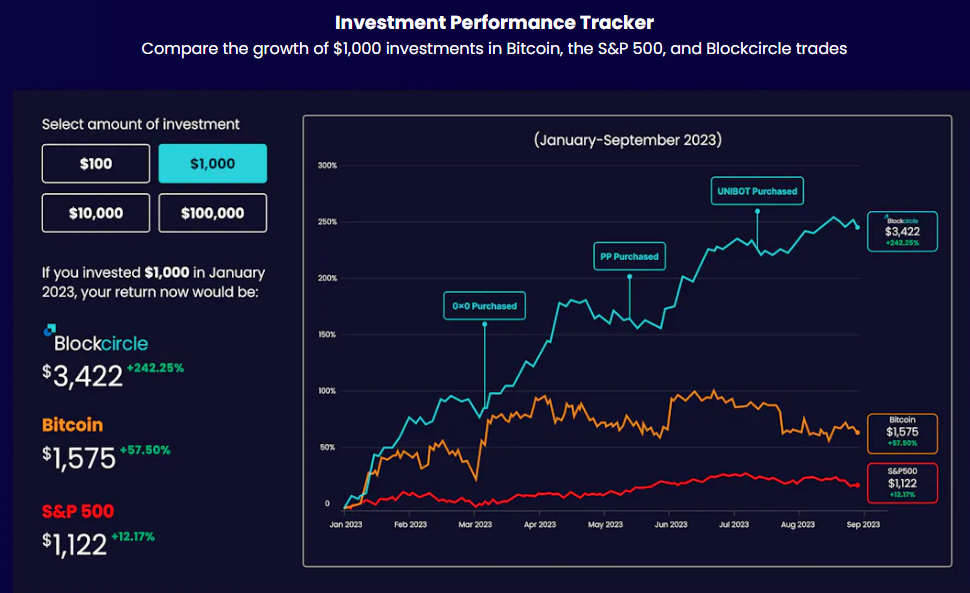

If you want to join a community of like-minded investors, learn from profitable traders and get access to over 20 hours of world class trading education for free, head over to Blockcircle now and get started.

The fallout of a breakout

Once broken through the resistance level, the coin’s price will rise to new levels. If the volume is still low, then the buyer’s confidence will increase. After this, in most cases, this creates a tension between the upward trend and the downward trend in price of the coin, fueled by investors who have an invested interest in pushing the price above the moving average and those trying to push it below this level. This is the best place to begin buying into the coin as a stop loss can be used to offset the risk associated with engaging in this trade. Soon, the buy volume will increase dramatically as investors rush to buy into the coin. This willingness to pay higher prices for the coin will push sellers to raise the price. Generally, once the breakout has risen to the same height as the first wave which started the trend, the price will slowly begin to decrease.

The entry point into a breakout

Depending upon the goal of your investment, there are two key entry points for a breakout. The first is to buy into the coin at the point where the resistance line has just been broken and the price is beginning to rise. Then wait for the price to increase. This position is suitable for those looking for a long term investment and is hoping the coin will rise in price. The second entry point is suitable for short term investments where the buyer hopes the coin will drop in price. It is recommended that this investor buys into the coin when the price of the coin is set to close below a support level. Once entered into this trade, the investor needs to be patient and wait for the breakout to occur. It is advisable to wait until the end of the trading day to make your investments as this will provide you with the best guarantee that the breakout will hold.

Exit point for a breakout

It is important that investors have a predetermined exit plan in place to ensure that the trade will be successful. It is important that your goal for the trade is reasonable and well calculated.

There are three main exit strategies an investor could implement:

-

Exiting with a profit

Itis important to determine a target price, that an investor will aim to reach during a trade. This can be done in a number of ways with the easiest being looking at the recent price action by examining charts that plot the coin’s price over time. If an investor is executing a successful trade, then it is advised that they remain in the trade until the coin has reached the predetermined price point or time target. At this point, they should pull out of the trade.

-

Exiting with a loss

It is important to recognize when an investment has failed and to exit the trade as soon as possible. After the breakout has occurred, old resistance levels become new supports and old supports become new resistance levels. This then provides a way to determine if a trade has failed and to determine stop-loss positions. It is advised that an investor closes the trade at the old support or resistance level.

Final Note About Breakout Trading

Breakout trading is very volatile and is characterized by investors making a rash investment or exit decisions. Using these tips can provide a guide for how to execute a breakout trade which is profitable and minimizes risk.