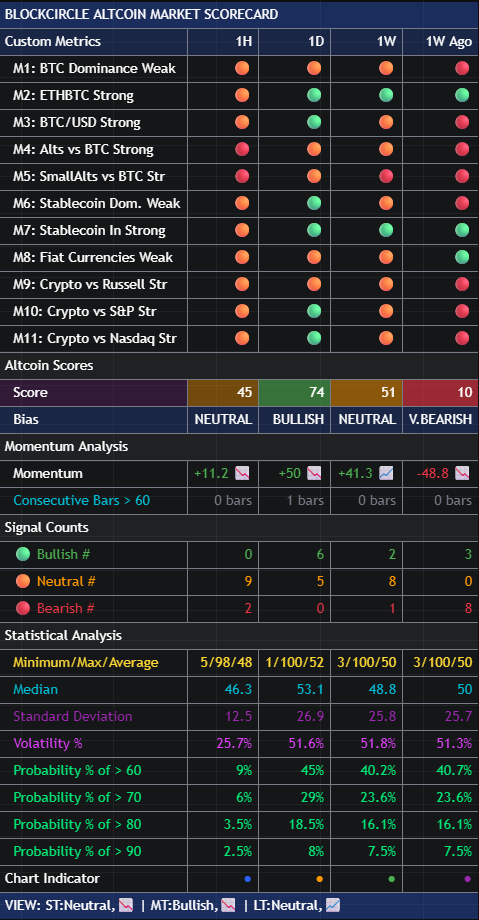

Altcoin

Market Scorecard

A snapshot of the market conditions

11 metrics that historically correlate with altcoin market conditions.

What the AMS Tracks

The AMS monitors relationships that have historically shown correlation with altcoin performance:

- Bitcoin dominance trends

- Altcoin performance relative to Bitcoin

- Stablecoin dominance and issuance rates

- Correlations with traditional risk assets

- Cross-market capital flow indicators

Score Interpretation

11 configurable entry conditions:

- 80-100: Historically favorable for altcoin exposure

- 60-79: Generally positive environment

- 40-59: Mixed conditions

- 20-39: Unfavorable conditions

- 0-19: Historically poor for altcoin performance

How to Use the AMS

The AMS indicates whether conditions historically favor altcoins. This is essential info for portfolio allocation decisions, position sizing, and timing. When conducting a portfolio review, the AMS helps calibrate exposure and risk.

High scores: may move towards larger altcoin positions.

Low scores: maybe more selective and may reduce exposure.

Altcoin Momentum Metrics

Track exactly how the Altcoin Market is moving, across multiple time frames, and monitor momentum to catch every thrust up and every thrust down

Should I be BULLISH or BEARISH towards altcoins?

Use Altcoin Market Scorecard (AMS)

1) Combined score of 80+? Market's running hot.

2) Score dropping below 40? Time to be defensive.

It's the "weather report" for crypto that actually updates in real-time.

Should I be going LONG or SHORT?

Built from the collective brainpower of senior quants, engineers, and scientists in the Blockcircle community.

11-metric market scorecard + 10 configurable indicators + institutional exit logic.

No hype. Just data.

How can I better manage my ENTRIES and EXITS?

Stop loss hit too early?

Took profit too late?

Missed the exit signal entirely?

MTE V3 has 6 different exit mechanisms - from ATR-based trailing stops to market sentiment triggers.

Because entries are easy. Exits are where the money's made (or lost).