COMPLETE SETUP & CONFIGURATION MANUAL

PREREQUISITES & INITIAL SETUP

Before beginning, ensure you have:

- A TradingView account (minimum Essential, preferably Plus+)

- Active Blockcircle subscription

Account Integration Process

- TradingView Account Creation -> Navigate to TradingView.com and create your account. Choose a username carefully, as this will be permanent and case-sensitive. Write down your exact username, including any numbers, underscores, or capital letters. For example, if you register as “Blockcircle_Trader1234”, this exact format must be used everywhere.

- Blockcircle Integration Visit blockcircle.com/account and enter your TradingView username exactly as registered. The system performs case-sensitive matching – “Blockcircle_Trader1234” will not match “blockcircle_trader1234”. After entering your username, you’ll receive access to the Blockcircle AMS – Altcoin Market Scorecard.

- Accessing Your Trading Chart -> Once logged into TradingView, click “Chart” in the top navigation menu. You’ll see a default chart appear. To change the trading pair, click the symbol in the top-left corner (usually showing “AAPL” or another default). Type your desired pair, such as “BTCUSDT,” and select the appropriate exchange (BINANCE, COINBASE, KRAKEN, etc.).

- Timeframe Selection Above the chart, you’ll see timeframe options (1m, 5m, 15m, 1h, 4h, D, W, M).

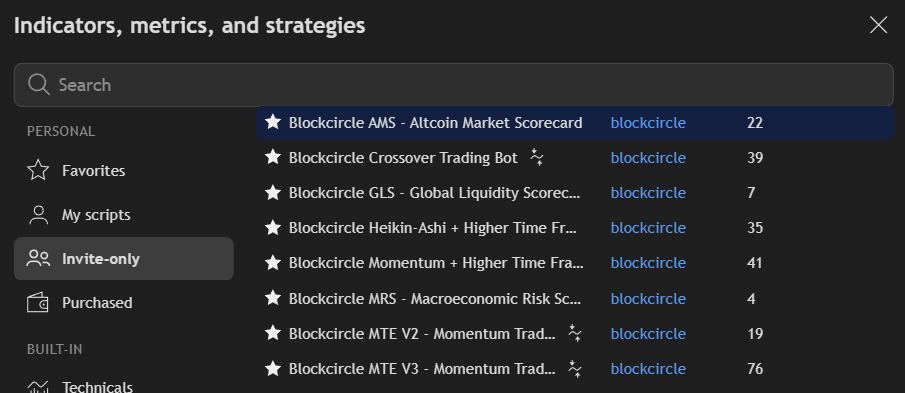

- Adding Blockcircle AMS – Altcoin Market Scorecard to Your Chart -> Click the “Indicators” button (looks like ƒx) at the top of your chart. In the search window that appears, navigate to the “Invite-Only” tab. You should see “Blockcircle AMS – Altcoin Market Scorecard” if your account has been granted access. Click on it once to add it to your chart.

Overview

The Blockcircle AMS is a comprehensive multi-timeframe analysis tool that provides real-time market sentiment for altcoins by analyzing 11 critical market relationships across multiple timeframes simultaneously.

Section-by-Section Guide

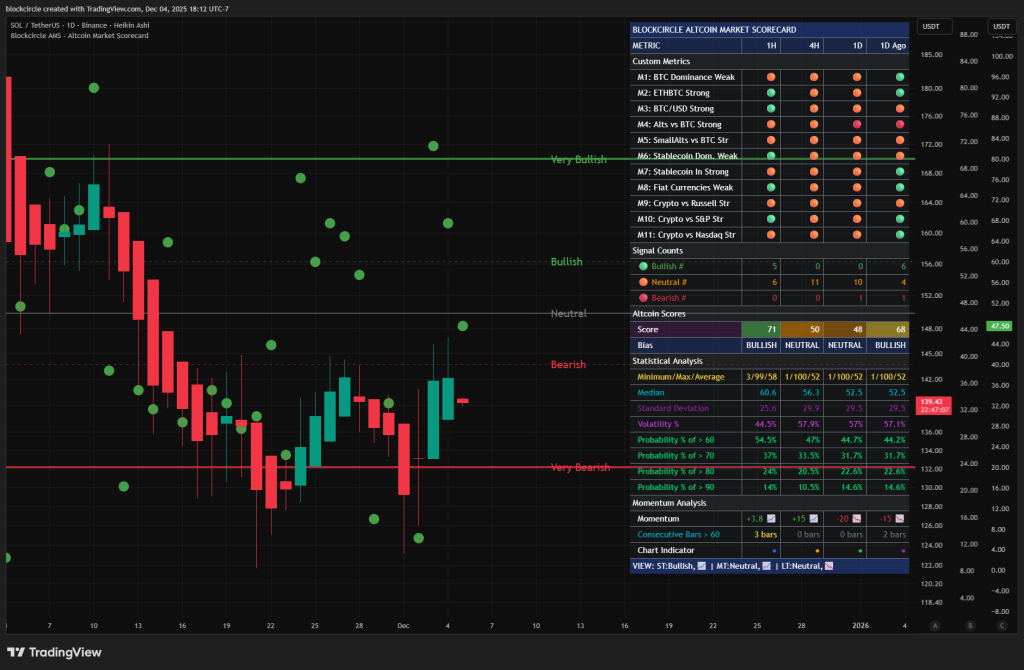

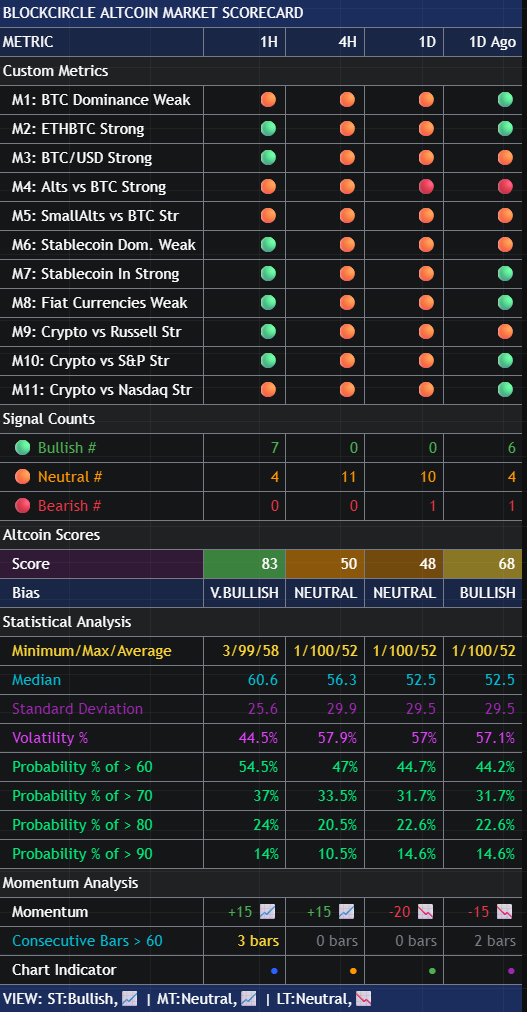

Header Section

- Timeframe Labels: Shows active timeframes (e.g., 1H, 1D, 1W)

- Chart: Uses current chart timeframe

- Ago: Indicates prior period comparison (useful for momentum analysis)

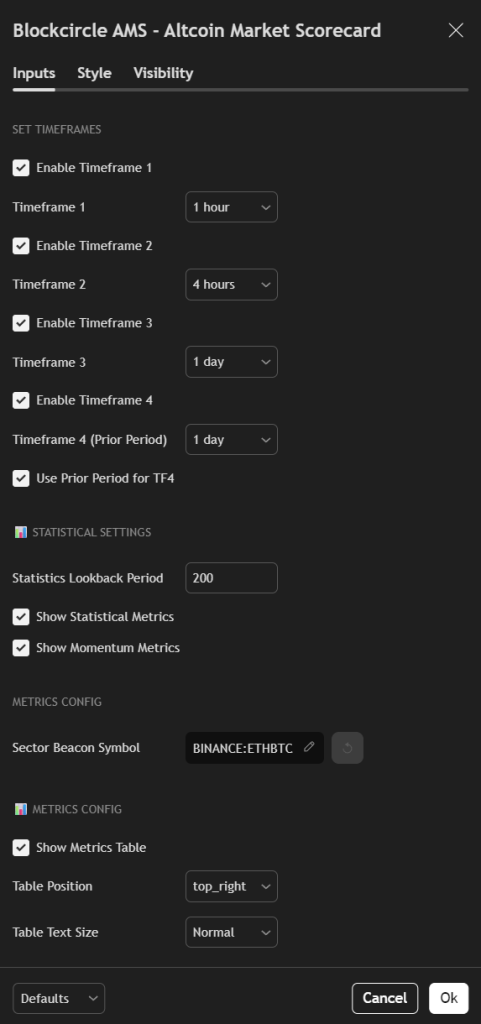

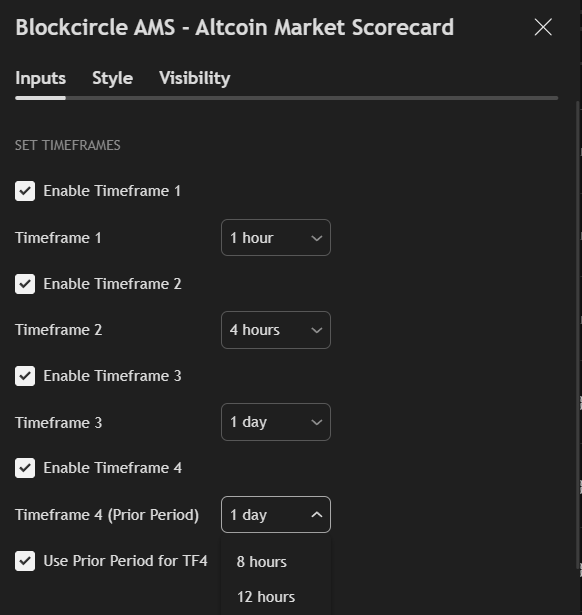

Input Tab Section

You can adjust the timeframes to 1-hour / 1-day / 1-week / 1-week ago as well, OR if you want a longer term view, you can set it to 1-day / 1-week / 1-month / 1-month ago, that would give you the full picture from multiple angles.

Market Metrics Section

This section displays 11 proprietary indicators using a traffic light system:

- 🟢 Green: Favorable for altcoins

- 🟠 Orange: Mixed/Neutral signal

- 🔴 Red: Unfavorable for altcoins

Key Metrics to Watch:

- M1 (BTC.D): Bitcoin dominance – When red, altcoins typically underperform

- M3 (BTC/USD): Bitcoin strength – Green helps mini altcoin seasons

- M6 (Stable.D): Stablecoin dominance – Green indicates money flowing into risk assets

- M9 (vs Russell): Crypto vs small-cap stocks – Green shows crypto outperformance

Signal Counts Section

Provides a quick visual summary of market conditions:

- Bullish Count >7: Strong altcoin conditions

- Neutral Count >5: Market indecision, wait for clarity

- Bearish Count >7: Consider defensive positioning

Altcoin Scores Section

Score Interpretation:

- 80-100: Very Bullish – Aggressive altcoin positioning warranted

- 60-79: Bullish – Favorable for altcoin exposure

- 40-59: Neutral – Selective positioning, focus on quality

- 20-39: Bearish – Reduce altcoin exposure

- 0-19: Very Bearish – Defensive stance recommended

Bias Field: Provides plain-language interpretation of the score

Set Timeframes

Statistical Analysis Section

Min/Max/Avg

- Shows historical range over the lookback period

- If the current score is near the maximum (Max), the market may be overextended

- If the current score is near the minimum (Min), there is a potential reversal opportunity

- Average (Avg) provides a baseline for comparison

Median

- More stable than average, less affected by extremes

- Score above median = Better than typical conditions

- Score below median = Worse than typical conditions

Standard Deviation (Std Dev)

- Measures score variability in absolute points

- High Std Dev (>15): Volatile market conditions

- Low Std Dev (<10): Stable market conditions

Volatility %

- Normalized volatility as percentage of average

- <20%: Low volatility, trends likely to continue

- 20-30%: Normal volatility

- >30%: High volatility, expect rapid changes

P(Score>50/60/70)

- Historical probability of bullish conditions

- P(Score>60) >70%: Historically bullish timeframe

- P(Score>60) <30%: Historically bearish timeframe

- Use for risk sizing: Higher probability = larger position sizes acceptable

Momentum Analysis Section

Bars > 60

- Consecutive periods above the bullish threshold

- >5 bars: Strong sustained momentum

- 3-5 bars: Establishing trend

- <3 bars: Early or weak momentum

Color Coding:

- Green: Strong momentum (>5 bars)

- Yellow: Building momentum (3-5 bars)

- Gray: Weak/no momentum (<3 bars)

Momentum

- First number: Score change from previous bar

- Positive (+): Improving conditions

- Negative (-): Deteriorating conditions

- Trend label:

- “Rising”: 5-bar average > 10-bar average (accelerating)

- “Falling”: 5-bar average < 10-bar average (decelerating)

- “Flat”: No clear trend

Trading Implications:

- +5.0 Rising: Momentum accelerating, trend likely to continue

- -3.0 Falling: Momentum deteriorating, consider reducing exposure

- +2.0 Flat: Improvement but no clear trend yet

Analysis Section

Chart Indicator

- Color-coded dots matching plot lines on chart

- Helps identify which timeframe each plotted line represents

Market Summary

- Plain-language interpretation across all timeframes

- ST (Short-term): intraday to few days

- MT (Mid-term): Days to weeks

- LT (Long-term): Weeks to months

Trading Strategies

Trend Following

- All timeframes bullish: Maximum altcoin exposure

- Mixed signals: Reduce position sizes

- All timeframes bearish: Move to stablecoins/BTC

Mean Reversion

- Score significantly below average with improving momentum: potential accumulation opportunity

- Score significantly above average with declining momentum: consider taking profits and waiting for a 1-week confirmation to derisk

Risk Management

- Use Volatility % to size positions (lower volatility = larger positions)

- Use probability metrics for confidence levels

- Monitor “Bars > 60” for trend exhaustion (>10 bars may indicate overbought)

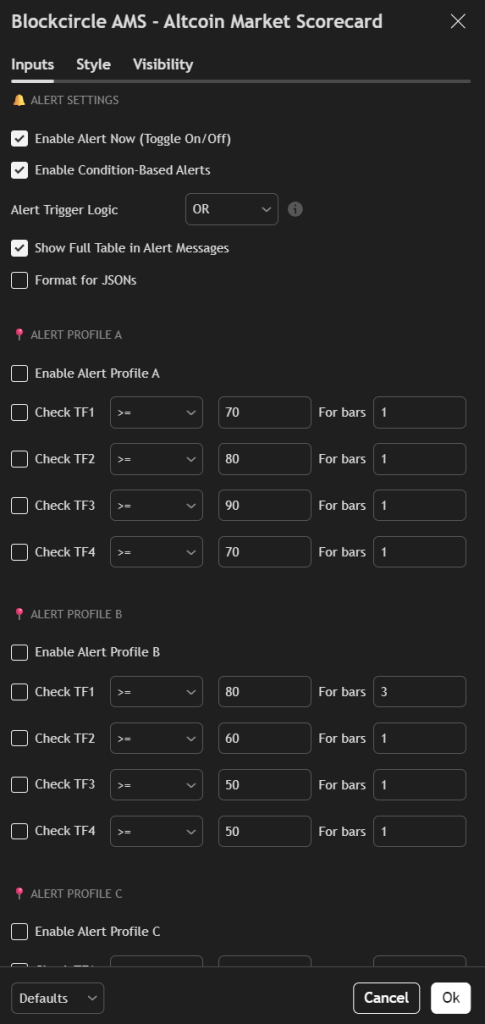

Alert Setup

- Set alerts when score crosses key thresholds (60 for bullish, 40 for bearish)

- Monitor momentum changes (positive to negative or vice versa)

- Watch for extreme readings (>90 or <10) for reversal opportunities