1. Introduction and Overview

What is the Alpha Hunter Suite (AHS)?

The cryptocurrency market generates an extraordinary amount of NOISE. Every day, traders are bombarded with paid promotions, influencer shills, and manufactured narratives, making it extremely difficult to identify SIGNAL, also known as legitimate opportunities. The Alpha Hunter Suite (AHS) was built specifically to solve this problem.

The Alpha Hunter Suite is a proprietary intelligence platform that tracks three specific types of alpha-generating events in real time: 1) tokens announced for centralized exchange (CEX) listings, 2) tokens actually getting listed on CEXs, and 3) brand-new token launches being accumulated by quality whales. The system scans data from over 20+ blockchain networks, pulls from centralized and decentralized exchange APIs, scrapes hundreds of sources for relevant data to evaluate the merits of projects, and tracks institutional wallet activity around the clock.

The suite consists of three distinct modules:

- Alpha Hunter Token Announcements: Tracks tokens announced to be listed on centralized exchanges before the listing goes live

- Alpha Hunter Token Listings: Monitors actual token listings across all centralized exchanges as they happen

- Alpha Hunter Token Launches: Scans over 100,000 new token launches daily to surface the handful worth exploring

Why This Suite of Tools Exists

Consider the scale of the problem: over 100,000 tokens launch every single day across various blockchains. The vast majority of these, well over 99%, are either outright scams, abandoned projects, or simply noise that never gains traction. Manually filtering through this volume is impossible. No human trader can evaluate that many tokens with any degree of rigor.

The Alpha Hunter Suite handles this heavy lifting through proprietary filters that eliminate low-quality tokens before they ever reach users. The system tracks whale wallets with proven track records, verifies contract security, checks liquidity locks, and analyzes holder distributions. By the time an alert arrives, it has already passed through multiple layers of verification.

This does not mean every alert is a guaranteed winner. Crypto markets remain inherently risky. However, the filtering process ensures that users evaluate opportunities from a much smaller, higher-quality pool than the general market.

Important Risk Acknowledgment

Important: Module 3 (Token Launches) involves significant risk. Even with rigorous screening, a substantial percentage of new tokens will fail, despite us screening out 99.997% of new launches! That is simply the nature of early-stage cryptocurrency markets. This tool should be used for the speculative, high-risk portion of a portfolio only. Never allocate capital to new token launches that cannot be lost entirely. The whales tracked by this system have deep pockets and can absorb losses that would devastate a smaller trader. Position sizing should reflect this reality and this is why we keep harping on the importance of proper risk management.

2. Prerequisites & Account Setup

Before utilizing the Alpha Hunter Suite, the following setup requirements must be completed.

Required Accounts

- Active Blockcircle subscription (https://blockcircle.com/pricing)

- Telegram account with a confirmed username

- Trading wallets on relevant networks (Solana, ETH, Base, BSC, depending on trading focus)

Blockcircle Account Configuration

Critical: The Telegram username must be entered exactly as it appears in Telegram. The authentication system is case sensitive. If the Telegram username is “Trader_2025” and “trader_2025” is entered in the Blockcircle profile, authentication will fail. This is the most common setup issue users encounter.

- Navigate to https://blockcircle.com/account/

- Log in with the credentials provided via email upon subscription

- Locate the Telegram Username field

- Enter the exact Telegram username without the @ symbol

- Save profile settings

- Wait approximately 5 minutes for system synchronization

Alpha Hunter Telegram Bot Setup

Once account configuration is complete:

- Open Telegram and search for @blockcircle_alpha_hunter_V1_bot

- Or navigate directly to https://t.me/blockcircle_alpha_hunter_V1_bot

- Click Start to initialize the bot

- The bot will authenticate the Telegram username against the Blockcircle account

- A confirmation message will appear upon successful authentication

Video Tutorial: For a visual walkthrough of the complete setup process, watch below

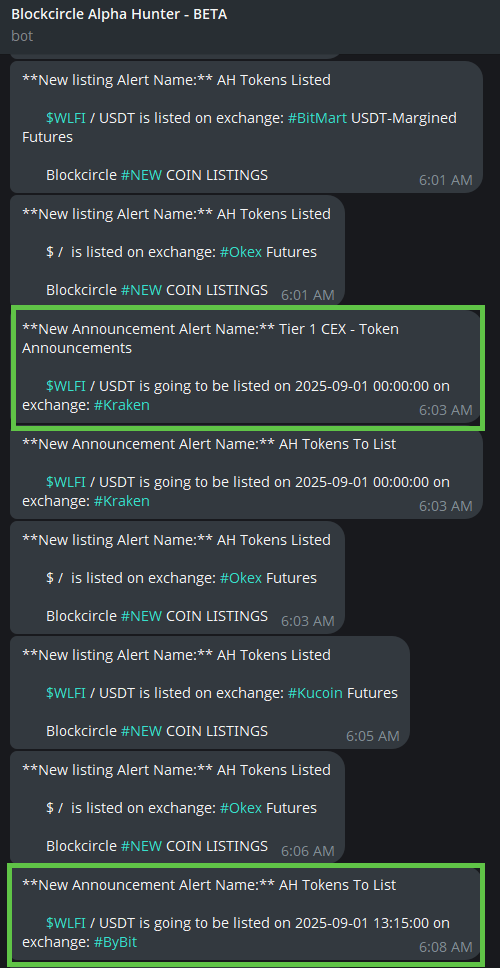

3. Module 1: Alpha Hunter Tokens To Be Listed on CEXs (Announcements)

What This Module Does

The Token Announcements module monitors every major centralized exchange for listing announcements. When Coinbase tweets about adding a new token, when Binance publishes a listing notice, or when Kraken announces new trading pairs, the system captures it and sends an alert immediately. The critical distinction here is “announced” versus “listed.” There is a window of time between when an exchange announces a listing and when trading actually goes live. That window represents the opportunity.

Why CEX Listing Announcements Move Markets

Our analysis demonstrates that CEX listing announcements create significant price movements. This effect stems from four primary factors: awareness expansion, accessibility improvements, liquidity injection, and validation signaling.

Factor 1: Massive Awareness Expansion

When Coinbase or Binance announces a listing, millions of users suddenly learn about that project. Coinbase has over 100 million registered users. Binance has even more. The majority of these users do not interact with decentralized exchanges. They are not scrolling through DEXScreener looking for new opportunities. However, when a token appears in their exchange app with a listing announcement, awareness is instantly created. This awareness alone generates buying pressure from market participants who would otherwise never have discovered the project.

Factor 2: Dramatically Increased Accessibility

Many crypto market participants find decentralized exchanges intimidating. Setting up wallets, bridging funds, managing approvals, and handling slippage creates friction that discourages participation. Centralized exchanges remove this friction entirely. When a token gets listed on a major CEX, anyone with a verified account can purchase it with a few taps. This represents a massive expansion of the potential buyer pool, effectively unlocking millions of users who were previously locked out of accessing that token.

Factor 3: Professional Market Making and Order Book Depth

This factor is frequently overlooked. When a token gets listed on a major exchange, professional market makers begin providing liquidity. These are not retail traders. These are firms with algorithmic trading systems and significant capital whose function is to maintain tight spreads and deep order books. This institutional liquidity accomplishes two things: it enables large orders to execute without massive slippage, and it signals to other institutional players that this token is now tradeable at scale. Hedge funds and trading desks that would never touch a DEX only token suddenly have a venue to build positions.

Factor 4: Validation Signal

Major exchanges, particularly Tier 1 platforms like Coinbase and Kraken, maintain compliance teams and listing review processes. When they announce a listing, it signals to the market that the project has passed at least some level of due diligence. This is not a guarantee of legitimacy, but it functions as a credibility stamp that many investors take seriously. This validation effect attracts capital from investors who use exchange listings as a quality filter for their decision making.

The Announcement to Listing Window

The time between announcement and actual listing varies by exchange. Sometimes it spans just a few hours. Sometimes it extends to a day or two. During this window, the token remains tradeable only on existing venues (typically DEXs or smaller exchanges), but informed capital is positioning ahead of the CEX launch.

Our backtesting shows that tokens announced for Tier 1 listings during bullish market conditions (when the Altcoin Market Scorecard shows positive readings) tend to appreciate 15% to 40% between announcement and listing. The strategy is straightforward: receive the announcement alert, perform quick verification, enter a position on whatever venue currently has liquidity, then evaluate exit timing as the listing approaches or goes live.

Exchange Tier Classification

Not all exchange listings carry equal weight. Exchanges are classified into tiers based on user base, liquidity depth, and market impact.

| Exchange | Why It Matters |

| Coinbase | Strong presence in US and European markets. Known for conservative listing standards. Compliance-focused user base. |

| Binance | Largest global trading volume. Binance listings provide access to the broadest global audience. Deepest liquidity and strongest volume impact of any exchange. |

| Kraken | Strong presence in the US, Canada, and European markets. Known for conservative listing standards. Compliance-focused user base. |

| OKX / Bybit | Major derivatives exchanges with large Asian user bases. Futures listings on these platforms can drive significant volume. |

Trading Strategies

Long Strategy (Bullish Markets)

When the AMS indicates bullish conditions and a Tier 1 listing announcement occurs, consider establishing a long position before the listing goes live. The thesis is that the combination of increased awareness, accessibility, and liquidity will drive buying pressure. Historical data supports this pattern during bull markets. Enter on DEX or existing CEX venues, set profit targets, and manage exit timing around the listing event.

Short Strategy (Delistings)

Delisting announcements create the opposite dynamic. Liquidity exits. Accessibility decreases. The validation signal inverts. Delisting announcements from prominent exchanges typically trigger price declines of 20% to 50%. For traders with access to shorting venues, these can represent high probability setups.

Market Condition Filter

This point is essential: the announcement strategy performs significantly better in bullish markets. When the overall crypto market trends downward, even positive catalysts get muted. Always check the Altcoin Market Scorecard before sizing into these positions. Bull market listings are momentum plays. Bear market listings frequently fizzle regardless of the exchange tier.

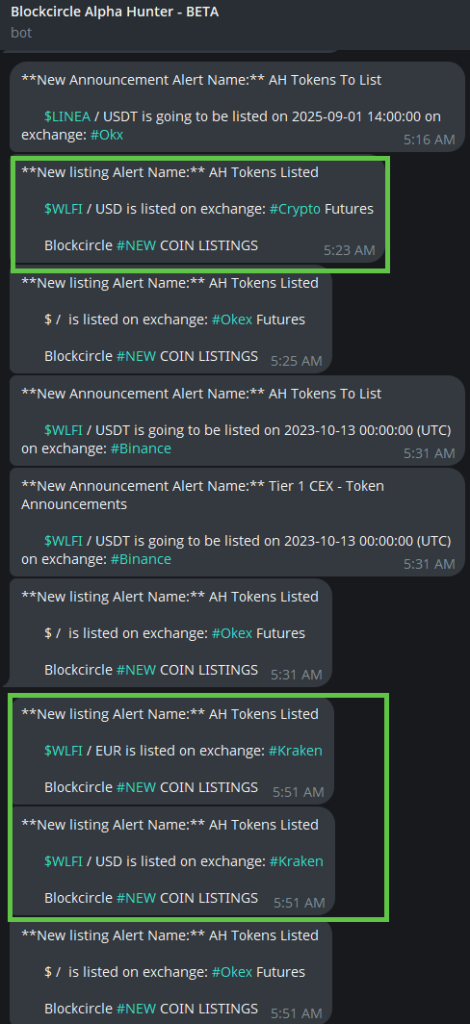

4. Module 2: Alpha Hunter Token Listed (Listings) on CEXs

What This Module Does

While Module 1 captures announcements before listings go live, Module 2 monitors actual listings as they occur across all centralized exchanges. The specific pattern identified here differs from the announcement play. This module focuses on the dynamics of smaller-capitalization tokens listed on smaller exchanges.

The Small Cap + Tier 3 CEX Pattern

Our data reveal a consistent pattern: when a small-cap token (generally under $50M market cap) is listed on a Tier 3 or smaller centralized exchange, rapid price appreciation frequently follows in the seconds to minutes to hours after listing. This may seem counterintuitive initially. Why would smaller exchange listings outperform large exchange listings? The mechanics explain this phenomenon.

Why Small Exchange Listings Drive Outsized Moves

First, smaller exchanges typically list tokens earlier in their lifecycle. A token might get listed on Gate.io or MEXC months before Coinbase or Binance would consider it. These smaller exchanges maintain less stringent listing requirements and move faster. This means earlier access in the project growth curve.

Second, when a small cap token receives even a modest influx of new buyers, the price impact is significant. Consider a token with $500K in daily volume. If a new exchange listing brings an additional $200K in buy pressure, that represents a 40% increase in demand hitting a thin order book. The price must move to accommodate this imbalance.

Third, smaller CEX listings often serve as stepping stones to larger exchanges. A token that successfully lists on Gate.io, builds volume there, and demonstrates genuine community support becomes a much more attractive candidate for Tier 2 and eventually Tier 1 exchanges. Early entry on the Tier 3 listing creates positioning for multiple catalysts as the token progresses up the exchange ladder.

How To Bring 1) Tokens to be Listed and 2) Tokens Listed Together

The Token Announcements and Token Listings modules together provide visibility into the full exchange progression pipeline that successful projects typically follow. Most tokens do not debut on Binance or Coinbase. They start on smaller Tier 3 exchanges, build trading volume and community support, then progress to Tier 2 platforms, and eventually attract Tier 1 listings if fundamentals remain strong.

This progression creates multiple distinct catalysts, each generating its own wave of price appreciation.

A recent example illustrates this pattern clearly: a project first appeared via listing on BingX, then announced on XT, followed by a KuCoin listing, then Binance Spot, and finally Binance Futures. At each step up the exchange ladder, the token experienced a tranche of appreciation as new pools of capital gained access.

Users tracking both modules could observe this entire progression unfold in real time, with each alert representing a potential entry or add point along the journey. Rather than discovering a project only after it reaches Coinbase or Binance, the AHS provides the opportunity to identify and accumulate during earlier stages when upside potential remains substantially higher.

Capital Flow Mechanics

Understanding the exact sequence of capital flows clarifies why this pattern works.

Before the listing, the token is available only on DEXs and perhaps one or two obscure exchanges. The buyer pool is limited to DeFi native users comfortable with on-chain trading. This might represent a few thousand people who even know the token exists.

The listing is announced. The token now appears in the listings of a centralized exchange with 500,000 to 2 million registered users. Even if only 0.1% of those users notice the new listing, that represents 500 to 2,000 potential new buyers who had no prior awareness of this token.

Trading goes live. A portion of those newly aware users decide to purchase. Market makers assigned to the new pair begin providing liquidity. Buy orders hit the books. Because the token is a small-cap with limited existing liquidity, even modest buy pressure moves the price.

This creates a feedback loop: price increases, more people notice, more buying occurs, price rises further. Early movers who entered when the listing went live capture this momentum.

Exchange Coverage

The system monitors listings across the full spectrum of exchanges:

- Tier 1: Binance, Coinbase, Kraken, OKX, Bybit

- Tier 2: KuCoin, Gate.io, Bitget, MEXC, Huobi

- Tier 3: Smaller regional exchanges and specialized platforms

Optimal Selection Criteria

Not every small cap listing warrants trading. Focus on tokens that demonstrate:

- Market cap under $50M (more room for appreciation)

- Active development team with a public roadmap

- Growing social following (organic, not bot farms)

- First or second CEX listing (maximum novelty effect)

- Actual utility or strong meme narrative with genuine community support

The listing itself is the catalyst. The fundamentals determine whether momentum sustains or fades.

5. Module 3: Alpha Hunter Token Launches on DEXs

The Whale Hunting System

Module 3 represents the most sophisticated component of the Alpha Hunter Suite. The system scans over 100,000 new token launches every single day across 20+ blockchain networks on all of the decentralized exchanges (DEXs). Out of those 100,000+ launches, the filtering system surfaces fewer than 2-3 that meet the criteria for potential quality, thus filtering out 99.997% of noise!

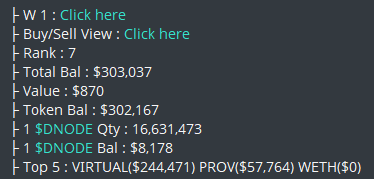

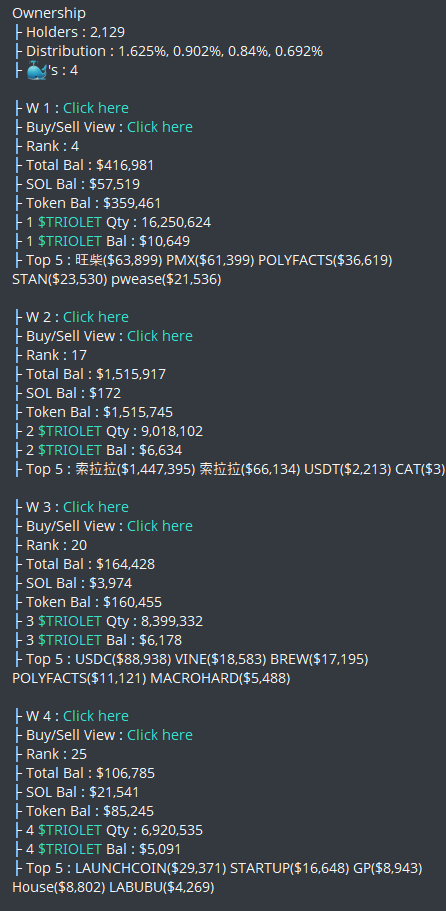

The core principle is straightforward: follow the smart money. The system tracks wallets controlled by high-performing traders, market makers, and institutional players. When multiple quality whales begin accumulating a brand new token, that signal warrants attention. These are not random wallets. These are addresses with six- or seven-figure balances and a proven track record of profitable trading across multiple market cycles.

One of the most valuable capabilities of the Alpha Hunter Token Launches module is its ability to surface investment narratives as they are forming, often weeks or months before they gain mainstream attention. When whale wallets begin accumulating tokens in a specific sector, whether AI agents, real world assets, decentralized physical infrastructure, or an entirely new category, the pattern becomes visible in the data before crypto Twitter starts discussing it.

This early visibility allows users to position ahead of the crowd rather than chasing narratives after they have already run. Equally important is what happens during bearish market conditions: the module goes quiet.

When market conditions deteriorate and quality opportunities disappear, the alert frequency drops significantly. This is not a system malfunction. This is the system working exactly as intended; it goes dormant when you want it to!

During periods when new token launches carry exceptionally high failure rates, the filtering criteria naturally produce fewer qualifying opportunities. The silence serves as its own signal, effectively protecting users from deploying capital into an environment where even properly vetted tokens face significant headwinds.

The Statistical Filtering Pipeline

Every token passes through multiple screening stages before reaching alerts.

Stage 1: Basic Viability Checks

Minimum market cap thresholds (dynamically adjusted based on market conditions), minimum liquidity requirements to ensure positions can be entered and exited, volume to market cap ratio analysis to filter inactive tokens, and minimum holder counts to verify real distribution.

Stage 2: Security and Honeypot Detection

This stage represents the proprietary advantage. The system runs comprehensive contract analysis through multiple security APIs, checks liquidity lock status, detects mint and freeze functions that could be used maliciously, pulls RugCheck scores, verifies liquidity burn percentages via TokenSniffer, and integrates GeckoTerminal security metrics. If a contract exhibits suspicious characteristics, it gets filtered before ever reaching users.

Stage 3: Whale Quality Assessment

Not all whales merit following. The system evaluates whale wallet quality based on total balance (a seven-figure minimum preferred), portfolio composition (presence of established quality projects), stablecoin allocation during market downturns (indicating sophisticated risk management), historical performance, and holding behavior patterns. A whale that holds positions indicates conviction. A whale who immediately sells may simply be receiving team kickbacks and we track, just click “Click Here” and you will instantly see when they bought and if they sold, as shown below.

Stage 4: Social and Legitimacy Verification

Does the project have a functional website? Is there a Twitter/X presence with real followers (not bots)? Is there a Telegram community? Discord? Did they pay for DEXScreener verification? These factors are not guarantees of quality but their absence raises red flags, or at the very minimum, pushes to proceed with extra caution!

Blockchain Coverage

Primary Networks (Highest Activity):

- Solana (including pump.fun, pumpswap, Boop, Bonk launches)

- Ethereum Mainnet

- Base

- BNB Smart Chain (BSC)

Secondary Networks:

Arbitrum, Avalanche, Polygon, Optimism, Linea, Scroll, zkSync, Mantle, Mode, Sonic, Abstract, Blast, and additional EVM-compatible chains

6. Token Launch Screening Checklist

When an Alpha Hunter Token Launch alert arrives, use this checklist to evaluate the opportunity. The checklist is divided into Pre-Buying Steps (before entering a position) and Post-Buying Steps (monitoring after entry). These steps should not be skipped, regardless of excitement about any particular alert.

PRE-BUYING CHECKLIST

Complete these steps before entering any position. Each item includes an importance weight to assist prioritization.

| Verification Step | Weight | Check |

| Verify Whale Count is greater than 1 | 0.10 | [ ] |

| Check if project has Website, X, Discord, Telegram | 0.10 | [ ] |

| Verify if DEXScreener is paid | 0.10 | [ ] |

| Monitor Token Value held by each whale | 0.10 | [ ] |

| Check Size of Whales (prefer 7 figures minimum) | 0.10 | [ ] |

| Check Token Composition of Whale portfolios (quality Tier 1 projects) | 0.10 | [ ] |

| Check Cabal Score (be wary if greater than 50%) | 0.10 | [ ] |

| Check if Volume exceeds Market Cap (potential coordinated pump) | 0.10 | [ ] |

| Check Fake Volume percentage (be wary if greater than 40%) | 0.05 | [ ] |

| Analyze Insiders Holders to Insiders Made Ratio (be wary if greater than 50%) | 0.05 | [ ] |

| Check Bundling Rate (if greater than 30%, examine composition closely) | 0.05 | [ ] |

| Check if Airdrop exceeds 20% (inflates holder count artificially) | 0.05 | [ ] |

| Check Liquidity Lock Score (verify if liquidity is permanently locked) | 0.05 | [ ] |

| Check if Dev and Team are Doxxed (better if yes) | 0.05 | [ ] |

POST-BUYING CHECKLIST

Once a position is established, continuously monitor these factors to inform hold or exit decisions.

| Monitoring Step | Check |

| Check the number of Dev Launches (a high number is a red flag) | [ ] |

| Check number of Replies (better if greater than 2) | [ ] |

| Search Popularity: 1D greater than P3 indicates an upward trend | [ ] |

| Holder Distribution Data: identify how many are holding over $100 | [ ] |

| Check if Holders divided by Open Token Accounts exceeds 70% | [ ] |

| Check Concentrate Rate (ensure Top 3 holders are under 50%) | [ ] |

| Determine if Project is Meme vs Utility (Meme is 100X riskier) | [ ] |

| Search Popularity: 1D greater than P3 indicates upward trend | [ ] |

| Search Popularity: 7D greater than P3 indicates sustained interest | [ ] |

| Search Popularity: 30D greater than P3 indicates long term trend | [ ] |

| Verify Website is original and functional | [ ] |

| Check Commonality with X Followers | [ ] |

| Check Social Metrics of Existing Followers (high scores indicate strong support) | [ ] |

| Determine if there is an actual functional application | [ ] |

| Check if X Profile is active and posting original content | [ ] |

| Check X engagement and social metrics of support | [ ] |

| Verify if Whales are still Holding or have derisked/sold | [ ] |

| Join Project Telegram and gauge activity vs shillers | [ ] |

| Assess community activity by X post raid performance | [ ] |

| Verify Holders Count is growing | [ ] |

| Check Price Action and verify asset remains in upward price channel | [ ] |

| Search Contract Address on X and assess project discussion | [ ] |

| Search $Symbol on X and assess project discussion | [ ] |

| Search GitHub code repository and verify originality (non-forked) | [ ] |

| Search GitHub and verify history of key contributors | [ ] |

| Search GitHub and verify authenticity of contributions | [ ] |

7. Automation Setup: End-to-End Trading

Important Note: This automation setup is advanced. There is nothing comparable on the market currently, which means optimal parameters are still being discovered collectively. Patience with the configuration process is essential.

Two-Stage Approach

Stage 1: Establishing Profitability

The initial focus should be on verifying that the system generates profits at all. Optimization comes later. The priority is getting the mechanics working reliably.

Stage 2: Optimization to Maximize Profit

Once profitability is established and data accumulates, exit strategies and risk parameters can be refined based on actual performance metrics.

Exit Strategy Profiles Under Testing

The following exit profiles are currently being tested across the user base. The optimal profile has not yet been determined, which is precisely what the community is working to identify together.

| Profile | Exit Strategy |

| Profile 1 | Exit every trade at 20% profit |

| Profile 2 | Exit every trade with a 30% trailing stop loss |

| Profile 3 | Exit 50% at 100% profit, then 30% trailing stop on remainder |

| Profile 4 | Exit every trade at 30% profit |

| Profile 5 | Exit every trade at 40% profit |

| Profile 6 | No automatic exits; manual management only |

Determining optimal parameters requires shared intelligence. Users are encouraged to report results so the community can optimize collectively.

Step-by-Step Automation Setup

STEP 1: Install and Configure Maestro Bot

- Navigate to https://t.me/maestro

- Click Signals, then SOL, then Maestro DMs

- Activate Auto Buy

- Set Buy Amount

- Click Sell Limit, then Configure Exit Parameters, then Add, then Confirm

Setting Up Wallets in Maestro:

- Import private key from ETH wallet into the BASE and BSC wallets

- Bridge ETH to BASE wallet and BNB to BSC wallet

- Maestro provides built in bridging services once wallets are configured

- Import private key for SOL wallet

Note: For users who prefer not to import private keys, Maestro can generate fresh wallets. Simply deposit funds directly into the generated wallets and back up the private keys and mnemonics.

STEP 2: Install Alpha Hunter Bot

Navigate to https://t.me/blockcircle_alpha_hunter_V1_bot

STEP 3: Install Auto Forwarding Bot

Navigate to https://t.me/Auto_Forward_Messages_Bot

STEP 4: Configure Forwarding

Set up a forwarding task in the forwarder bot to automatically send Alpha Hunter alerts to Maestro Bot. Retrieve the bot IDs from the forwarder application to configure this properly.

STEP 5: Set Up the Forward Task

Example format: forward alphahunter [SOURCE_ID] to [MAESTRO_ID]

STEP 6: Test the Complete Flow

Test by pasting a contract address for a well-known large-cap token. Verify auto buy executes correctly. Then manually exit the test position once the end-to-end flow is confirmed.

8. Frequently Asked Questions

Q: The Telegram bot says the account is not authorized. What should be done?

A: In nearly all cases, this results from a username mismatch or from the fact that you don’t have an active Blockcircle subscription. Navigate to https://blockcircle.com/account and verify the Telegram username matches exactly what appears in Telegram settings. The system is case sensitive: CryptoTrader is different from cryptotrader.

Q: How quickly should users act on Token Launch alerts?

A: Speed matters significantly. The best opportunities often see rapid price movements within the first 3-60 minutes. However, due diligence should not be skipped due to urgency. A methodical 10 to 15-minute analysis using the Pre-Buying Checklist is preferable to an impulsive entry.

Q: Should every alerted token be purchased?

A: No. Alerts serve as starting points for analysis, not automatic buy signals. Use the screening checklist. Check market conditions via the AMS. Never allocate more capital than can be lost entirely on any single position.

Q: What position size is appropriate for Token Launch plays?

A: Individual positions should be limited to 1% to 2% of total portfolio value. Total exposure to the Token Launch strategy should remain under 5% to 10% of the portfolio. This approach limits downside while maintaining meaningful upside exposure when winners materialize.

Q: How should exit timing be determined?

A: Monitor the Post-Buying Checklist items. Key exit signals include: whales selling their positions, declining holder count, price breaking below support levels, and deteriorating community activity. The automated exit profiles provide systematic alternatives for users who prefer rules-based approaches.

Q: Why do some alerts show N/A for certain metrics?

A: Data availability varies by blockchain and token age. Very new tokens may not have all metrics populated yet. Some third-party data providers experience occasional outages. N/A values should prompt additional manual verification rather than automatic disqualification, it doesn’t mean they are immediate red flags.

Q: Can other trading bots be used besides Maestro?

A: Yes. Any Telegram compatible trading bot that accepts contract addresses can work with the forwarding setup. Maestro is documented due to its robust multi chain support, but the forwarding architecture works with most alternatives.

Q: How frequently should positions be monitored?

A: For Token Launch positions, monitoring at a minimum every few minutes, simply because of the high-risk nature of the projects being launched. New token dynamics can shift rapidly. Users who cannot commit to active monitoring should use automated exit strategies with manageable stop-losses, which can all be done with any established trading bot like Maestro Bot, Banana Gun, Bonk Bot, Photon Bot, etc.

Q: What defines a quality whale?

A: Quality whales demonstrate: six-figure or seven-figure portfolio values, diversified holdings including established projects, high stablecoin allocation during market downturns (indicating active risk management), consistent profitability, and a tendency to hold positions rather than immediately flip.

9. Final Notes

The Blockcircle Philosophy

The Alpha Hunter Suite was built on the principle that data beats hype. The crypto market generates enormous noise, manufactured narratives, and paid promotions. Cutting through this requires systematic, quantitative analysis. That is what this tool provides, alongside the Altcoin Market Scorecard (AMS), Global Liquidity Scorecard (GLS), Macroeconomic Risk Scorecard (MRS), and the Momentum Trading Engine (MTE).

Support Resources

- Video Setup Guide: https://www.youtube.com/watch?v=ly4QllUXSI0

- Account Management: https://blockcircle.com/account/

- Alpha Hunter Bot: https://t.me/blockcircle_alpha_hunter_V1_bot

- Maestro Bot: https://t.me/maestro

- Banana Gun Bot: https://t.me/BananaGunSniper_bot

- Bonk Bot: https://t.me/bonkbot_bot

- Auto Forwarder: https://t.me/Auto_Forward_Messages_Bot