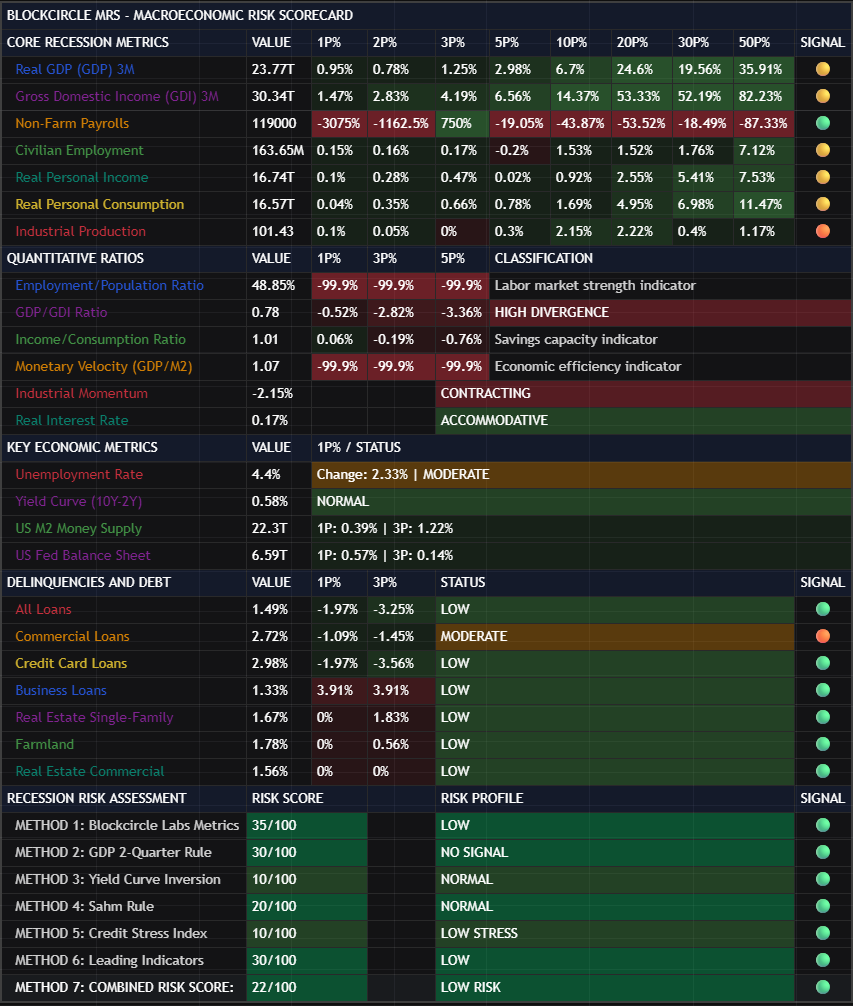

Macroeconomic

Risk Scorecard

A Snapshot of Macroeconomic Risk

Six recession methodologies. 30+ economic indicators.

Purpose of Macroeconomic Risk Scorecard (MRS)

The MRS tracks indicators that historically precede economic downturns. This risk management framework shows when market conditions are deteriorating.

7 X Recessionary Risk Forecasting Methods

- Blockcircle Methodology: Metrics used by the official recession-dating committee.

- GDP 2-Quarter Rule: Traditional technical definition.

- Yield Curve: Has preceded every US recession since 1955.

- Sahm Rule: Designed to trigger at recession onset.

- Credit Stress: Delinquency rates and credit conditions.

- Leading Indicators: Forward-looking composite.

- Composite: combination of above six methods

Using The GLS Risk/Opportunity Scores

Combined score below 40: conditions historically favorable. Above 60: elevated risk – consider tighter stops, reduced exposure, or increased cash.

The scorecard doesn’t predict recessions. It surfaces the data that historically preceded them.

Multi-timeframe View of Global Money Supply and Net Liquidity

A combination of established macroeconomic variables and custom quantitative ratios is used to assess potential run-ups or drawdowns with respect to speculative asset classes.

Newsletter

Subscribe to our newsletter to get regular content.

Resources

© Blockcircle 2025. All rights reserved

When you visit or interact with our sites, services or tools, we or our authorised service providers may use cookies for storing information to help provide you with a better, faster and safer experience and for marketing purposes.