Momentum

Trading Engine

Generate long and short trades for any asset

A complex algorithm involving dozens of metrics and AI language models to identify entries and exits

What is the MTE?

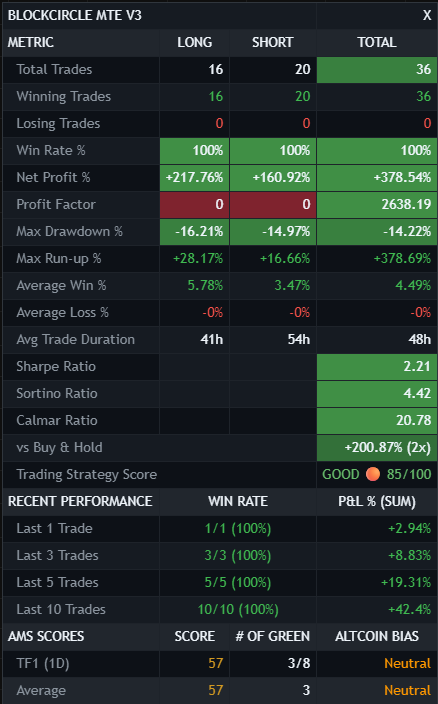

The Momentum Trading Engine allows you to select entry conditions, configure parameters, combine multiple systems, and run backtests against historical data. The engine displays the backtested historical performance of a given configuration, it’s profitability, drawdown, winrate, and more.

Entry Systems

11 configurable entry conditions:

- Momentum-based triggers

- RSI thresholds and divergences

- Stochastic crossovers

- MACD conditions

- Money Flow Index levels

- Price action structures

- Multi-timeframe confirmations

Systems can be used individually or combined. For example: require momentum confirmation AND RSI conditions AND alignment with the Altcoin Market Scorecard.

Exit Management

Configurable exit logic includes:

- Trailing stops with adjustable parameters

- Time-based exits

- Invalidation conditions

- Profit targets

Performance Metrics

Every backtest generates: total trades, win percentage, average win vs. average loss, maximum drawdown, Sharpe ratio, profit factor. These help evaluate whether a configuration is worth testing live.

Note: Backtest performance doesn’t guarantee live results. Market conditions change. Use metrics as information, not predictions.

Community Configurations

Members have shared 200+ tested trading configurations. These serve as starting points. You can load a configuration, analyze its performance, and then adjust to fit your risk tolerance and market view.

Momentum Trading Engine (MTE)

The Momentum Trading Engine allows you to select entry conditions, configure parameters, combine multiple systems, and run backtests against historical data. The engine displays the backtested historical performance of a given configuration, it’s profitability, drawdown, winrate, and more.

Should I be BULLISH or BEARISH towards altcoins?

Use Altcoin Market Scorecard (AMS)

1) Combined score of 80+? Market's running hot.

2) Score dropping below 40? Time to be defensive.

It's the "weather report" for crypto that actually updates in real-time.

Should I be going LONG or SHORT?

Built from the collective brainpower of senior quants, engineers, and scientists in the Blockcircle community.

11-metric market scorecard + 10 configurable indicators + institutional exit logic.

No hype. Just data.

How can I better manage my ENTRIES and EXITS?

Stop loss hit too early?

Took profit too late?

Missed the exit signal entirely?

MTE V3 has 6 different exit mechanisms - from ATR-based trailing stops to market sentiment triggers.

Because entries are easy. Exits are where the money's made (or lost).